In the past, the process of applying or switching mortgages has been long and complicated. However we at moneysherpa are determined to change that and make the process of getting our customers first mortgage or switching to a new one as easy and straightforward as possible.

When applying for a mortgage or switching, one of the most important steps is uploading the correct documents so your application is approved by lenders. The quicker the correct documents are uploaded the quicker your application will be approved, that’s why we are going to outline exactly which documents you need to upload to successfully get or switch your mortgage.

What Documents do I need to upload?

For your mortgage/switching application, you’ll need to upload:

- Proof of Identity

- Proof of Address

- Payslips

- A Salary Certificate (Not needed if switching)

- An Employment Detail Summary

- Bank Statements

1. Proof of Identity

What can this be?

This can either be:

- Your passport.

- Your driver’s license (the front AND the back).

- Your National ID card.

It’s important to make sure that the document you upload is in date, that all 4 corners are visible, and that no information is being covered or else your document won’t be approved.

- Passport

2. Drivers Licence

3. National ID Card

2. Proof of Address

What can this be?

This can be a utility bill, for example an electricity bill, bank statement, or revenue documents that are dated within the last 6 months.

It’s important to make sure that your address is included the document that you upload.

3. Payslips

How many do I need to upload?

You’ll need to upload 3 months of payslips. Unless you are switching with Avant in which case you only need your last payslip.

How recent do they need to be?

These must be payslips from the last 3 months.

4. Salary Certificate

You will need a signed, dated, and stamped salary certificate from your employer. If you are switching mortgage we only need this if you have a bonus or commission payment we need to include.

You can get a salary certificate directly from your employer, or you can get your employer to fill out a generic one that can be accessed here.

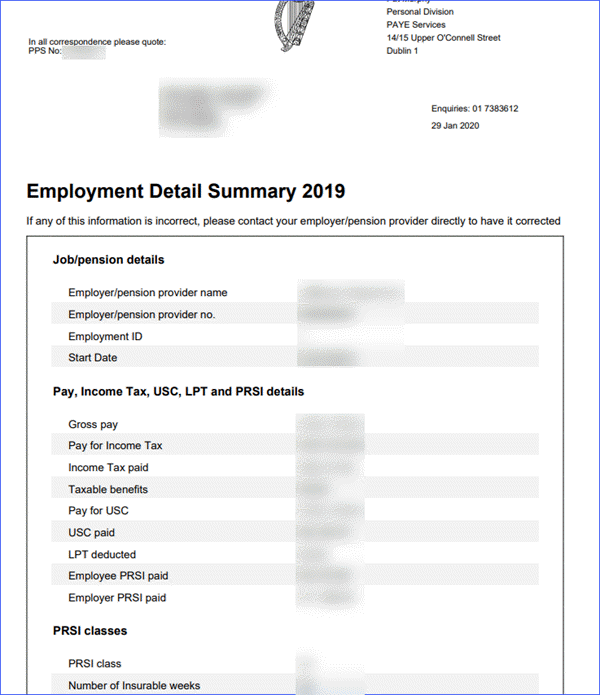

5. Employment Detail Summary

The Employment Detail Summary, formerly called the P60, can be obtained from the Revenue Commission.

Once you’ve logged into your “myAccount” on Revenue, click on “View your Employment Detail Summary (EDS) documents” in the PAYE services section and select the year you would like to download. This will create your Employment Detail Summary for that year which can then be found in “My Documents” section on Revenues homepage.

6. Bank Statements

What Bank Statements do I need to upload?

You will need to upload:

- Current account statements, including statements from secondary accounts such as Revolut.

- Savings account statements.

- Credit Union statements.

- An-Post statements.

- Savings plans.

- Credit card statements. Not required if switching.

How up-to-date do these need to be?

You will need your last 6 months of up-to-date bank statements, with the last transaction or date of the statement needing to be within the last 4 weeks.

For savings accounts, only the latest statement is needed if you are switching.

Make sure it’s the actual statements you download and not a transaction report so we can get your documents right the first time round.

How do I order my bank statements?

We’ve made a step-by-step guide on how to order statements from every Bank, Credit Card Company, and Credit Union in the country.

Simply click on the lender you need to get your statements from and we’ll tell you exactly how to order them.

- Bank of Ireland

- AIB

- Permanent TSB

- Avant

- Revolut

- Credit Union

- EBS

- KBC

- Ulster Bank

- Haven

- Mars Capital

- Pepper

- Start Mortgages

- Finance Ireland

- ICS Mortgages

How do I upload my Documents?

We have a step-by-step video down below that shows you how to upload your documents once you’ve got them here.

In a nutshell- Uploading your documents.

So in short, these are the documents you will need to upload to get your mortgage application/switching journey started:

- Proof of Identity.

- Proof of Address.

- Your most recent 3 months payslips unless you are switching.

- A Salary Certificate signed, dated and stamped by your employer. Unless switching.

- An Employee Detail Summary from the Revenue Commission.

- Your most recent 6 months Bank Statements.

When uploading your documents, there is a “Chat” feature where you can get in touch with one of our mortgage sherpas if you have any questions/ queries whatsoever.

Ordering your statements:

Bank of Ireland

Statements can be ordered on the bank of Ireland portal 365 online for current accounts, demand deposit and instant access demand accounts. For Credit Card holder’s only copies of existing issued statements can be requested.

- Log in to your account on the Bank of Ireland App.

- Tap ‘Services’ on the bottom menu.

- Select ‘Manage statements’.

- Choose ‘Order an up-to-date statement’.

- Select which account would like a statement for. (You will need to provide statements for all of your accounts).

- Choose if you would like to be notified when the request is complete and tap ‘Continue’.

If that doesn’t work you can check out other options here.

AIB

The statement will be for the period from your last statement issue date to the date of ordering.

- Log in to AIB Mobile Banking.

- Select Services and tap Statements.

- Select the account you want to order a statement on.

- Click on Order more recent statement.

If that doesn’t work you can check out other options here.

Permanent TSB

Although you can download E-statements from your online account they may not be up to date. Don’t worry though you can get an up to date E-statement generated by doing the following.

To order up to date statements:

- Log into Open 24 on a PC or Laptop (you will need you Internet Password as well as you six digit Personal Access Number).

- Select your Account.

- Select Statements.

- Select Order Postal Statements – You will get a “Success” message.

- Your updated E-statement will take 48 hours to go live.

To access your E-statements you can use the Mobile App:

- On the app home page, click the main menu icon (three lines) in the top left hand corner of the home screen.

- Click on ‘eStatements’.

- Confirm your Personal Access Number (PAN).

- Click on the account you wish to view eStatements for.

- Select the E-Statement you wish to view and it will download as an PDF E-statement on your phone.

If that doesn’t work you can check out other options here.

Avant Money

1. Log in to your Avant Money App.

2. Tap Statements on bottom.

3. Download statements for the last 6 months.

If up to date statements are not available, you can order them from Avant directly on 0818 409 511.

Revolut

- Open the ‘Accounts’ tab on your home screen.

- Tap the ‘Account selector’ dropdown.

- Select the currency account you need.

- Tap ‘…’ to see more.

- Select ‘Statement’.

- Choose the date range and file format.

- Tap ‘Generate’ and you’ll be able to see your account history.

- To download it, tap the ‘Export’ icon in the top-right corner of the screen.

If that doesn’t work you can check out other options here.

Credit Union

Even though Credit Union online platforms are unique, they all have the option to access, download and order account statements.

- If you don’t have online access to your Credit Union account(s), please refer to your local branch and request up to date statements to be sent to you.

- Please make sure to order statements for all of the accounts you have, as Credit Unions may have a number of different accounts assigned to one account holder (such as Disperse account, EFT Current Account, Shares, Loan account).

- Please make sure if you have a CU loan to submit an up to date statement for that as well.

EBS

Call 0818 654323 or head into an EBS Branch to order your statements which will have to be sent by post. This is the only way to receive statements that will have your name and address on them.

KBC

You can visit the KBC website that show you how to access your eStatements here: Where can I find my eStatements online? – KBC

If you need statements for a recently CLOSED account, call 1800939244.

Ulster Bank

The Ulster Bank website will show you how to download your statements and other mail here:

How do I download a PDF statement or other mail?

If you need statements for a recently CLOSED account, go to:

https://www.ulsterbank.ie/help-and-support.html

Click: “Chat to Corona”.

Type “My account is closed I want to orders duplicate statements” into chat box and follow the prompts.

Haven

Your statements are issued annually by post. You can call 0818 565 500 to order a replacement.

Mars Capital

Call 1800 852 940 or email [email protected] with your mortgage account number to order your statement.

Pepper

Call 0818 818 181 with your mortgage account number to order your statement which will come through post.

Start Mortgages

Usually issued at end of the year. A duplicate can be ordered by calling 0818 220 666 or emailing [email protected].

Finance Ireland

Call 01 6470250 or email [email protected] with your mortgage account number and your statements will be posted to you.

ICS Mortgages

ICS Mortgages issues annual statements in early January of each year. If you do not have this to hand, you can call the ICS Mortgages customer service team on 0818 542 542 or email [email protected]