Raisin bank offers Irish customers higher rates on both their Fixed and Demand savings accounts. But is Raisin bank safe? Here’s why we think it is and how it works.

Introduction

Raisin Bank was originally a German Bank and now is one of the biggest European savings platforms. They allow their customers to choose the best interest rates from different banks in the EU. This gives their customers over 400 banks to choose from, in 30 different EU countries.

They operate under the German banking Act. Which allows them to operate safely and with complete protection. Raisin Bank came to Ireland in 2019, as Irish people are subject to the lowest retail interest rates in Europe. They offer their Irish customers over 3x the standard Interest rate found in Irish banks.

| Best Fixed Term Saving Accounts | Bunq | Raisin | AIB | Bank of Ireland | Permanent TSB | State Savings |

| Savings Rate (AER) | 3.36% | 3.65% | 2.75% | 2.50% | 2.5% | 1.32% |

| Term | Instant | 1 Year | 1 Year | 1 Year | 1 Year | 3 Year |

| Conditions | upto €100,000 | upto €100,000 | €15,000 – no limit | €5,000 – no limit | €5,000 – no limit | €50 – €120,000 |

The good news is if you’re thinking about signing up to Raisin Bank. If you sign up, you can earn a bonus from just making a deposit.

Keep in mind this offer is a limited offer. If you want to find out more about the offer please click here.

Is Raisin Bank Safe?

In 2013 Raisin moved on to offering different rates and becoming a savings platform. Raisin is backed by leading European and American investors. That includes Goldman Sachs, Deutsche Bank, and PayPal.

In 2021, Raisin merged with the leading B2B deposits platform, Deposit Solutions. Forming one of the biggest Open Banking fintechs in Europe.

Raisin collaborates with the largest banks in Europe. – among them are Aviva, Crédit Agricole Consumer Finance, Deutsche Bank, Klarna, N26, Renault Bank, Unicredit, as well as many other savings, cooperative and community banks.

Raisin Bank, being based in Germany is regulated by the BaFIN (German Federal Supervisory Authority). BaFin is one of the top regulators in Europe. They supervise banks, insurance companies, other financial institutions and are trusted regulators within Germany and the EU.

Raisin have their full license under the German Banking act. Which is an Act for the safety of any assets entrusted to institutions, meaning your money is insured.

What is the Deposit Guarantee Scheme?

Raisin have adopted the European Deposit Guarantee Scheme (DGS). Raisin bank and the partnered banks decided to adopt this scheme as it suits and benefits both parties. So that up to €100,000 can be guaranteed and safely transferred to Raisin Bank and to the partnered banks.

Raisin bank who act as the middle man in the procedure can safely hold up to €100,000 with the DGS scheme. Your money will also be safe after transferring the money, as Partnered banks are also with the DGS scheme. Keeping your money safe throughout!

All partnered banks have a deposit guarantee of up to €100,000, bar the Swedish TF Bank, who operate in the Swedish Krona, have a deposit guarantee of up to 1,050,000 kr, which is just under €100,000.

In the table below are the partnered banks, offered to banks in Ireland and their Deposit Guarantee Schemes.

Deposit Guarantee Schemes by Country

| Countries | Protection Ceiling |

| Austria | €100,000 |

| Czech Republic | €100,000 |

| France | €100,000 |

| Italy | €100,000 |

| Latvia | €100,000 |

| Poland | €100,000 |

| Portugal | €100,000 |

| Slovakia | €100,000 |

| Norway | €100,000 |

| Sweden | 1,050,000 kr |

| Germany | €100,000 |

Are the Raisin Partnered Banks Safe?

All partnered banks with Raisin are with the (DGS) European Deposit Guarantee Scheme or national equivalent. Which guarantees up to €100,000 to be safe and protected when deposited.

Each bank is then further regulated by their own countries laws & regulations. Some also by EU laws & regulations, which gives a Raisin customer some clarity over their money’s safety.

Raisin bank partners generally with banks from the EU. Most of the partnered banks have EU regulators, on top of the national regulators each of the banks have. This means the partnered banks are safe and will protect your money.

Where partner banks aren’t in the EU they have the national equivalent. For example Norway’s Morrow Bank is nationally regulated by the Financial Supervisory Authority of Norway. Though it isn’t technically part of the EU DGS it is still covered as they’re part of the Norwegian Banks’ Guarantee Fund, which ties into the €100,000 DGS that Raisin hold.

Key Information on Partnered Banks:

A&G Banco = Spain

A&G Banco is a private bank headquartered in Madrid, Spain, founded in 2014 as part of the A&G Group which dates back to 1987. Specializing in wealth management and private banking services. With a reputation for integrity and expertise, A&G Banco has established itself as a trusted partner in the Spanish financial sector.

Banca Privata Leasing = Italy

Banca Privata Leasing is an independent, private bank, specialized in leasing and online deposit-taking. The bank also has offices in Milan.

BFF Bank = Italy

BFF Banking Group is the largest operator of specialized finance in Italy and a leading player in Europe. BFF Bank is an Italian bank (i.e. has a banking license in Italy) but offers deposits on Raisin.ie through its Spanish branch in Madrid.

TF Bank = Sweden

TF Bank, founded in 1987 in Borås (Sweden), has grown significantly since its inception. It operates in several countries.

Younited Credit = France

Younited Credit S.A. is an online credit banking platform founded in 2009 by an experienced team of bankers in Paris. Today the platform is the leading platform for online credit institutions in France.The business is not only successful in France; Younited Credit is also active in Spain and Italy.

Banco Português de Gestão = Portugal

Founded in 2000. The bank has its main office in Lisbon and has another branch located in Porto. Banco Português de Gestão is majority-owned by the private Foundation Fundação Oriente.

Alior Bank = Poland

Alior Bank is a Polish retail bank with headquarters in Warsaw. Since its foundation in 2008, the number of customers has risen to over 3 million. With 6,500 employees and an extensive retail network consisting of 216 branches, 219 modern mini branch locations (Alior Bank Express), as well as 414 partner branches.

Euram Bank = Austria

Euram Bank (European American Investment Bank AG), an independent Austrian private bank based in Vienna, was founded in 1999 and has since established itself in the areas of private and investment banking.

J&T Banka = Czech Republic

J&T Banka a.s. (‘J&T Bank’) was founded in 1998 in Prague, Czech Republic. The bank is considered a reliable partner for customers expecting the highest standards in service and product.

Morrow Bank = Norway

Morrow Bank, an Norwegian-based online bank, specializes in consumer finance, offering a versatile range of financing solutions. With expertise spanning a decade, this fully digital bank serves customers in Sweden, Norway, and Finland.

Privatbanka = Slovakia

Privatbanka from Bratislava, Slovakia was founded in 2005. Privatbanka, despite its small size, belongs to one of the banks with the highest long-term profitability in Slovakia. Privatbanka’s professional team of bankers have helped its position in the private banking market, by bringing customer deposits under management to 530 million euros.

Privatbanka = Latvia

BluOr Bank AS was founded in 2001 and is headquartered in Riga, the capital of Latvia. BluOr Bank focuses on modern, user-friendly banking combined with individual service. The bank is the ninth largest bank in the country in terms of assets under management.

How does Raisin actually work?

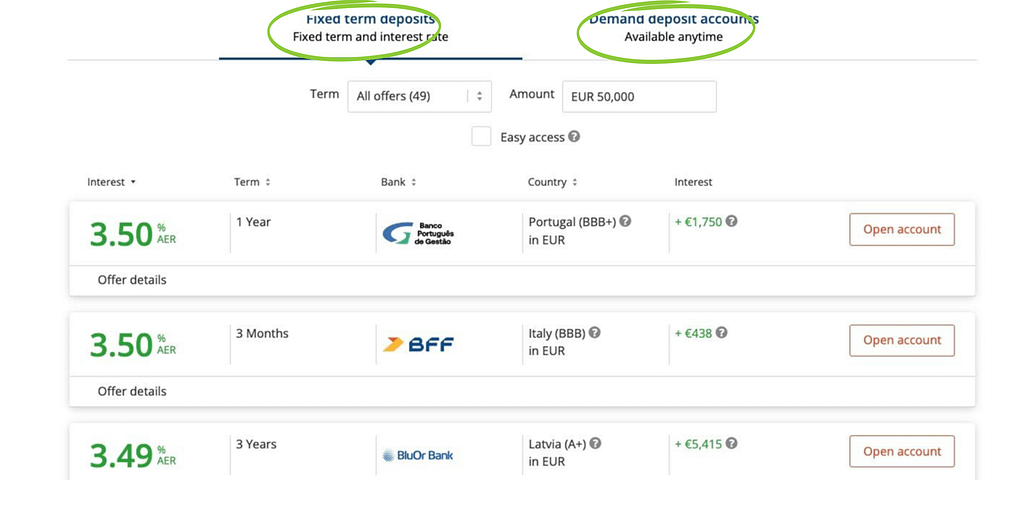

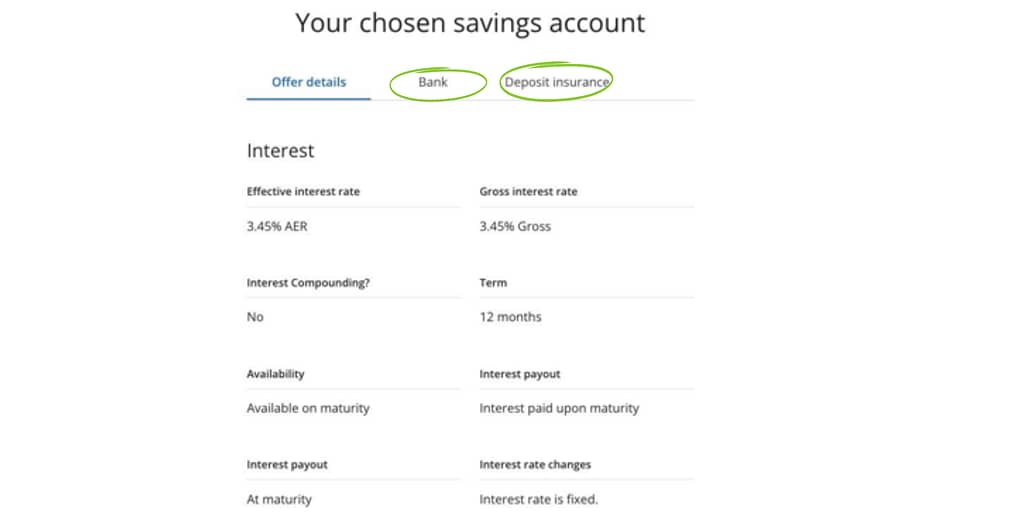

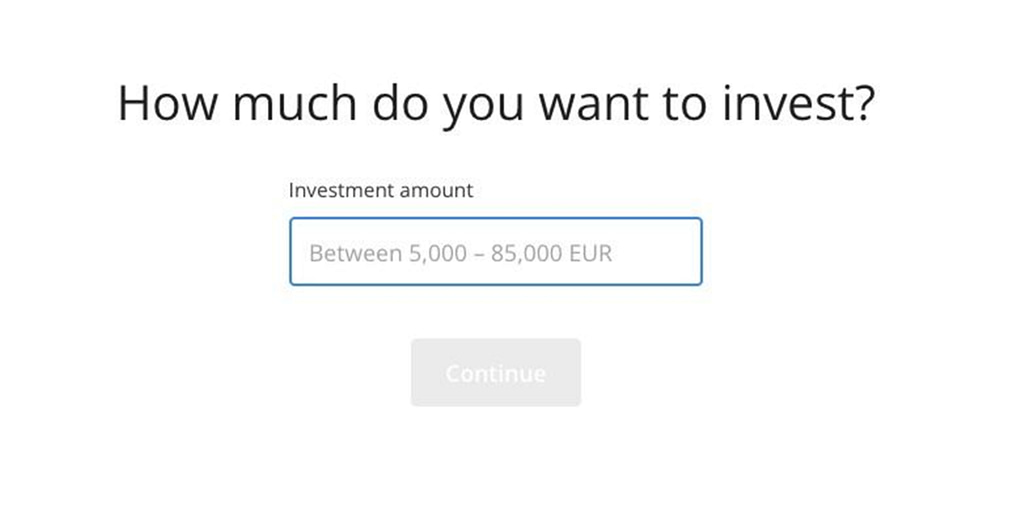

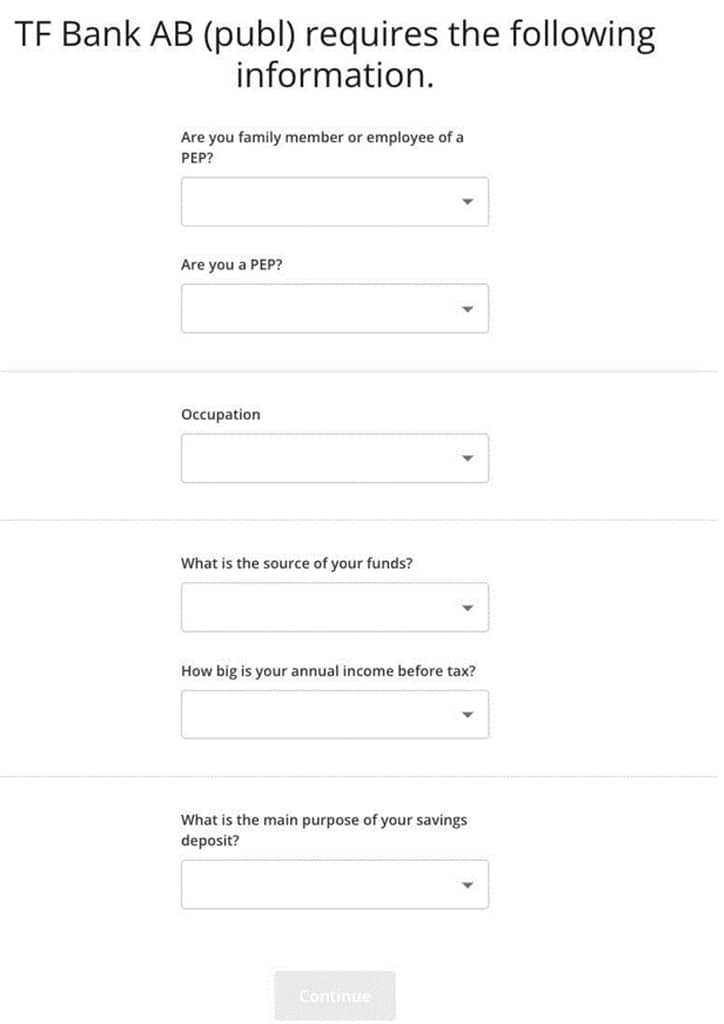

Simply: You go onto the Raisin website or app. Then create an account with Raisin. Look at the rates and regulations and then choose one of the partnered banks.

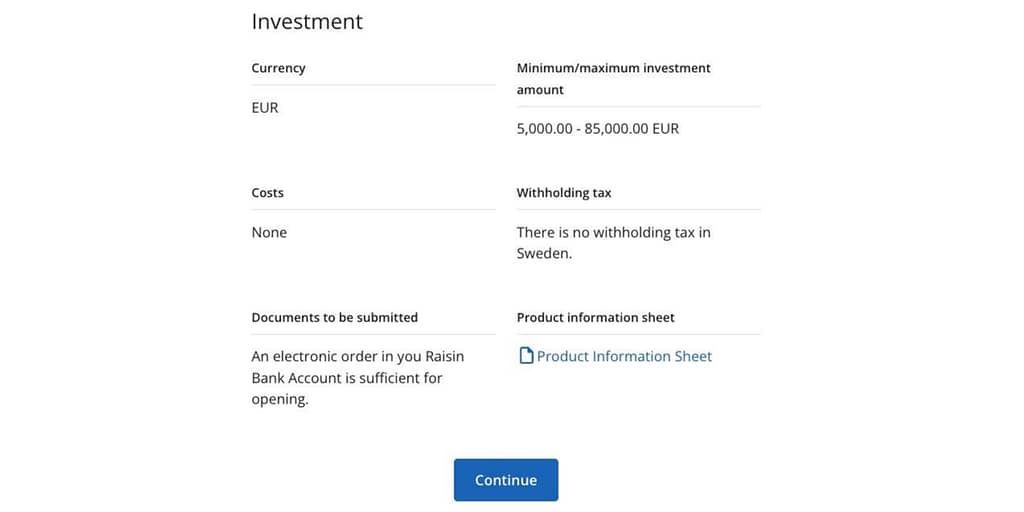

Then, look at what documents are needed for that specific partnered bank. File the correct documentation to the bank of choice, through raisin. They’ll do the background work while you need to verify the legitimacy of the documents you are sending.

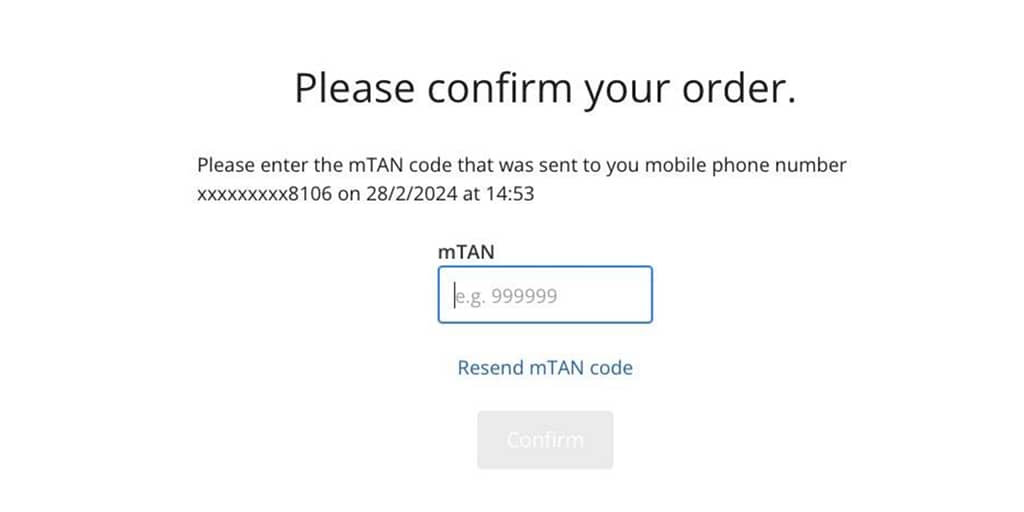

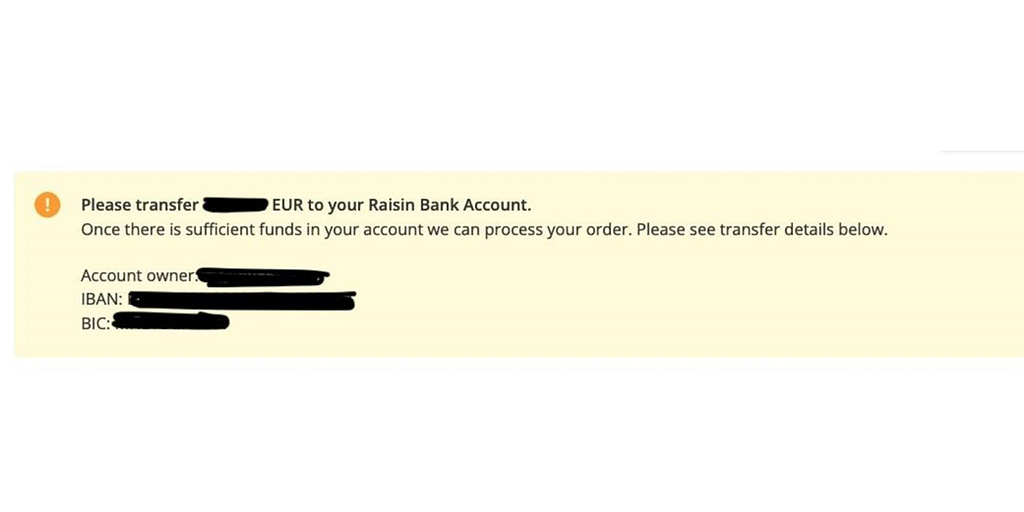

If you haven’t already, you can then transfer the money into your Raisin account, as you can only then deposit the money into the bank of choice, after the documentation has been filed and verified. Raisin then set-up an account with the bank of your choice.

So once all documentation is filed and you’re verified. Then you transfer the money from your Raisin bank account into your new bank account, in the bank of choice.

Raisin will provide you with an IBAN in your online banking account. With a long term savings account, you will not be able to withdraw money until your term is complete.

When your term is complete though, you then transfer the money from the partnered bank to your Raisin account. Then transfer the money from your Raisin account, back to your own account. This process is done safely and securely, but may take up to 1 – 3 business days to transfer the money.

How does your tax work with Raisin?

When using an Irish bank you’re charged with a 33% DIRT (Deposit Interest Retention Tax) and typically don’t have to self-declare your tax, as the Irish banks do it for you.

When opening a bank abroad without a local withholding tax you still have to pay the 33% DIRT, but you also will have to file a Form 12, self-declare your own tax, as banks abroad cannot declare your tax legally.

How to file form 12: A Form 12 is an Income Tax Return. Which you will have to file through the Revenue, by filling out a pdf paper form 12 and sending it to the revenue through their myAccount system.

When opening a bank abroad with a local withholding tax, you firstly will have to file correct and extra documentation.

You won’t have to pay more than 33% on your interest though once you get your paperwork right. In some cases you will have to split your 33% ‘DIRT’ between two countries, Ireland and the country of chosen bank. If you don’t file the correct documentation you would be paying more than 40% on your interest and this could also be split between two countries.

Picking a country with withholding tax may provide higher interest rates compared to those without withholding tax, although it will mean you have extra documentation to file, specific to country and bank, on top of the self-declaration (Form 12) document. You will have to file documentation to the Irish revenue and to the bank abroad of choice, which can be a hassle. So check if the difference between the rates make the hassle worthwhile.

Withholding Tax by Country

| Countries | Standard Withholding Tax | Reduced Withholding Tax |

| Austria | 25% | 0% |

| Czech Republic | 15% | 0% |

| France | 0% | 0% |

| Italy | 0% | 0% |

| Latvia | 20% | 10% |

| Poland | 19% | 10% |

| Portugal | 28% | 15% |

| Slovakia | 19% | 0% |

| Norway | 19% | 0% |

| Sweden | 0% | 0% |

| Germany | 0% | 0% |

Standard withholding tax is a tax on your interest earned on savings. Which the local banks will charge on top of your DIRT if you do not reduce it with the correct documentation.

Other than Latvia, Poland and Portugal the withholding tax will then be completely reduced by filing the right paperwork, so you pay 0% withholding tax. For Latvia, Poland and Portugal the reduced withholding tax is taken from your DIRT, again if you file the right paperwork you still pay 33% on your interest earned from savings split between 2 countries.

As an example, if you were to file the correct documentation with a Latvian bank 10% of your interest earned on savings will go to Latvia and 23% of your interest earned on savings will go to Ireland, DIRT. So if you were to not file the documentation with a Latvian bank, 20% would be taxed on your interest on savings and then DIRT at 33% will also be taxed on your interest on savings.

Summary

Raisin is a safe and big savings platform which operates from Germany. The only real difference when saving with Raisin and saving with an Irish bank (other than the interest rates!) is having to file documentation through Raisin and self declaring your income with a Form 12 through the Revenue.

They’re backed and regulated by top banks and established regulators in their own country and the EU. The banks they partner with are established banks that are regulated by their own countries’ national regulators. Both sides also uphold a €100,000 Deposit Guarantee Scheme, which should give your regular saver complete comfort and safety in choosing Raisin.

Raisin Bank offers their services all over Europe and is continuing to grow and will offer better rates as times goes on. They’re definitely an option that every Irish saver should consider allowing you to use the interest rates from banks abroad, such as, Italy, France, Poland, Latvia, Norway and Sweden to name a few.

| Best Raisin Saving Accounts | Banco Portuges | BFF | Youunited | Banca Privata | TF Bank AB | A&G Banco |

| Savings Rate (AER) | 3.50% | 3.00% | 3.42% | 3.10% | 3.35% | 3.10% |

| Term | 1 Year | 1 Year | 1 Year | 1 Year | 1 Year | 1 Year |

| Conditions | €20,000-€100,000 | €20,000-€100,000 | €2,000-€100,000 | €5,000-€100,000 | €1-€100,000 | €10,000-€100,000 |

| Click to Apply | Invest Now | Invest Now | Invest Now | Invest Now | Invest Now | Invest Now |

The average interest rate in Ireland is around 1.5% – 2%. With BOI offering a 2% Interest rate on a 12 month fixed savings account. In comparison to Raisin offering an interest rate between 3-4% in several different banks on a 12 month fixed saving account.

Next Steps

The rates that Raisin bank offer their Irish customers are here.

If you want to set up an account with Raisin bank, click here.

More information regarding the Deposit Guarantee Scheme & Raisin banks safety, Check here.

And if you would like to find out more about Raisin bank please click here.

Other articles we have done on Raisin bank, here.

Raisin Bonus Offer T&Cs

If your opening balance is… Your bonus will be…

€5,000 to €29,999 €25

€20,000 to €49,999 €50

€50,000 to €84,999 €75

€85,000+ €100

*Please note: You must open an account with a minimum balance of €5,000 to qualify for this bonus. So make sure your first account has an opening balance of at least €5,000.

How to qualify for the bonus:

- To qualify for the bonus of up to €100*, you must sign up for a Raisin Account by Aug 15, 2024 using the promotional code RAISINBANK100 (Enter the code in the “promotional code” box when completing your registration.)

- After registering, you must open a savings account with Raisin Bank and fund this account with a minimum deposit of $5,000. A term deposit must have a minimum term of at least 6 months, or in the case of a demand deposit must be funded for at least 6 months. The savings account must be fully funded by June 30, 2024, to be eligible for the bonus.

- The bonus will generally be paid out to your Raisin Account within 14 days after meeting the criteria, i.e.:

-If you choose to open a term deposit account, within 14 days of opening the account -If you choose to open a term deposit account, within 14 days after the first 6 months have passed.

- This offer is open to new customers who sign by clicking ‘Register now’ through this page and use the specified promo code during registration. The offer is subject to change and may be withdrawn at any time without prior notice.

By participating in this promotion, you agree to be bound by these terms and conditions, as well as Raisin’s general terms of service. The bonus is only valid for private customers and cannot be combined with other referral and/or bonus campaigns.

To sign up for a Raisin Account click here.

4 thoughts on “Is Raisin Bank Safe and How Does it Work? – Ultimate Guide Ireland 2024”

I must say I was quite skeptical about Raisin Bank at first, but after reading this detailed guide, I have a much better understanding of how it works. The explanation of the escrow account system was particularly helpful in alleviating my concerns about safety. I’m definitely considering opening an account now, thanks for the thorough guide!

I really appreciate the transparency and detailed information provided in this post! I was considering opening an account with Raisin Bank but had some doubts about their security. This guide has put my mind at ease and I’m more confident in using their services now. Thanks for sharing your expertise, Money Sherpa!

I’m considering depositing a fair amount of money. I’m in the United States, and I was reading about the 33% tax on interest paid. I’m not sure how that works for depositors living in the United States? And insite would be appreciated, thank you.

Hi Jeffrey, if you are investing the money in an irish bank from the US there is a double taxation agreement so your local taxes will apply. If you are investing via Raisin in another EU bank he 33% is for Irish residents only. There is likely to also be a double taxation agreement between the US and the Country you are Investing in, but check the Raisin website to make sure. Hope that helps! Mark