15 bang up to date mortgage statistics and housing statistics that will keep you ahead of the pack. Despite a need for great data about one of the most important policy areas current statistics on the housing and mortgage market are inconsistent and hard to find. We’ve crunched the numbers and scoured the studies for you, so you can get it all in one place.

The 15 Key Mortgage and Housing Statistics:

- How big is the mortgage market Ireland 2023? – Mortgage Statistics

- What is the average mortgage in Ireland 2023?– Mortgage Statistics

- What percentage of people have a mortgage Ireland 2023?– Mortgage Statistics

- What percentage of people are mortgage free Ireland 2023?– Mortgage Statistics

- What is the most popular mortgage type Ireland 2023?– Mortgage Statistics

- What is the average outstanding mortgage length Ireland 2023 – Mortgage Statistics

- How many people are in mortgage arrears Ireland 2023?– Mortgage Statistics

- How many people are with vulture funds Ireland 2023?– Mortgage Statistics

- What is the current mortgage rate in Ireland 2023?

- How many mortgages are issued every year in Ireland 2023?– Mortgage Statistics

- How many people switch mortgage Ireland 2023?– Mortgage Statistics

- What percent of people are homeowners in Ireland 2023?– Housing Statistics

- What percent of people rent in Ireland 2023?– Housing Statistics

- What is the average monthly rent in Ireland 2023?– Housing Statistics

- What is the average house price in Ireland 2023?– Housing Statistics

Key Mortgage Statistics Ireland 2023

1. How big is the mortgage market Ireland 2023?

There is over €77 Billion in outstanding residential mortgages in Ireland currently, with 712,145 mortgages and 569,716 residential mortgage holders in total. With 1.2 mortgages per mortgage holder, based on Central bank data and moneysherpa projections of current mortgage holders.

| Mortgage Market Ireland | Private Household | Buy To Let | Total |

|---|---|---|---|

| Outstanding Mortgages (M) | €79,421 | €3,685 | €83,106 |

| Mortgage Accounts | 712,347 | 70,057 | 782,404 |

| Mortgage Holders | 569,899 | 56,046 | 625,945 |

2. What is the average mortgage in Ireland 2023?

The average mortgage for a private household is €135,574, based on Central bank data and moneysherpa projections of current mortgage holders.

| Mortgage Market Ireland | Private Household | Buy To Let | Total |

|---|---|---|---|

| Outstanding Mortgages (M) | €79,421 | €3,685 | €83,106 |

| Mortgage Holders | 569,899 | 56,046 | 625,945 |

| Average Mortgage Size | €139,360 | €65,750 | €132,769 |

3. What percentage of people have a mortgage Ireland 2023?

34% of all Irish households currently hold a residential mortgage based on moneysherpa analysis of CSO census data and Central Bank mortgage data.

| Housing | Volume | Percentage % |

|---|---|---|

| Mortgage Holders [1] | 569,899 | 34% |

| Home Owners [2] | 1,147,552 | – |

| All Households [2] | 1,697,665 | – |

4. What percentage of people are mortgage free Ireland 2023?

53% of home owners and 36% of all households are mortgage free, owning their own home with no mortgage or loan outstanding on it according to the latest CSO data.

| Housing | Volume | Percentage % |

|---|---|---|

| Owned Outright [1] | 611,877 | 36% |

| All Households [2] | 1,697,665 | – |

5. What is the most popular mortgage type Ireland 2023?

38% of Irish mortgage holders have a variable mortgage, followed by 36% with a tracker mortgage and 25% with a fixed mortgage based on the latest data available from the Central Bank of Ireland.

| Mortgage Accounts Ireland | Fixed | Variable | Tracker | Total |

|---|---|---|---|---|

| Residential Mortgage Accounts | 427,287 | 121,064 | 170,915 | 712,347 |

| % of total | 60% | 17% | 24% | – |

| Residential Mortgage Holders | 341,830 | 96,851 | 136,732 | 569,716 |

6. What is the average outstanding mortgage length and amount Ireland 2023?

38% of Irish mortgage holders have a variable mortgage, followed by 36% with a tracker mortgage and 25% with a fixed mortgage based on the latest data available from the Central Bank of Ireland.

| Mortgage Accounts Ireland | Fixed | Variable | Tracker | Total |

|---|---|---|---|---|

| Outstanding Term (Years) | 19 | 13 | 11 | 15 |

| Outstanding Value(M) | €48,383 | €10,689 | €18,169 | €77,241 |

| Outstanding Value per Holder | €141,541 | €110,365 | €132,880 | €135,578 |

7. How many people are in mortgage arrears Ireland 2023?

| Arrears Status | Accounts | Mortgage Holders |

|---|---|---|

| Total > 90 days arrears + | 17,723 | 14,178 (19%) |

| Of which > 5 years arrears + | 11,623 | 9,298 |

8. How many people are with vulture funds Ireland 2023?

| Closed Fund Status | Mortgage Holders |

|---|---|

| Total Closed Fund Mortgages | 90,104 |

| Performing Tracker | 25,625 |

| Performing & Fixed | 7,500 |

| Performing Variable | 12,500 |

| Restructured | 13,638 |

| In Arrears | 20,496 |

9. What is the current mortgage rate in Ireland 2023?

| Housing | Tracker (PDH) | Variable Rate | Fixed 1 Yrs+ |

|---|---|---|---|

| Private Household | +1.15% | 4.02% | 2.85% |

| Buy To Let | +1.08% | 4.39% | 3.82% |

10. How many mortgages are issued every year in Ireland 2023?

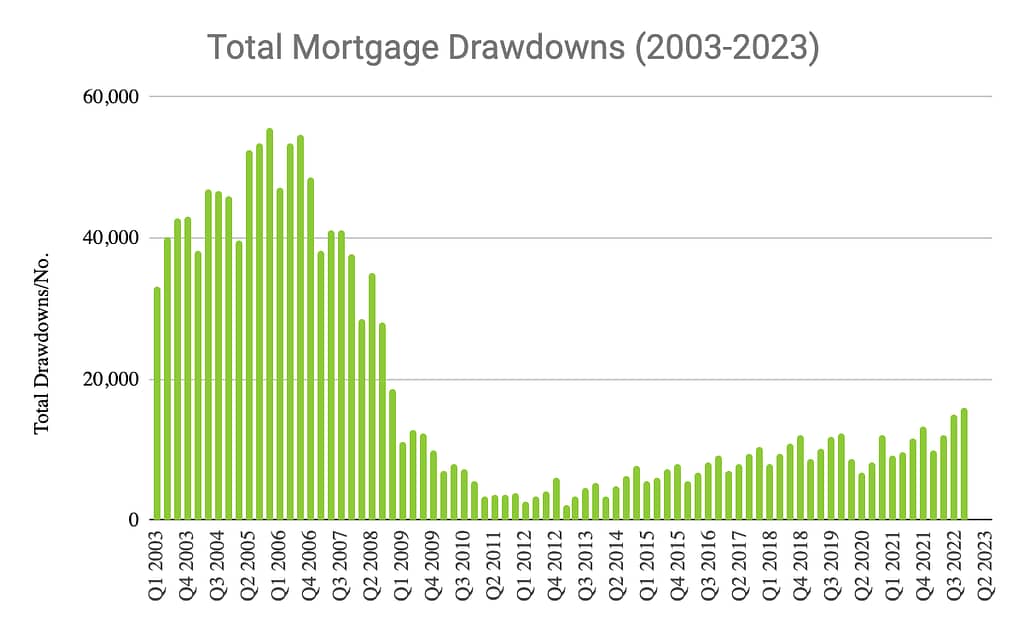

52,634 new mortgages were issued last year in Ireland down from a peak of 204,000 in 2006 according to moneysherpa analysis of BPFI drawdown data.

11. How many people switch mortgage Ireland 2023?

3.08% of existing mortgage holders switch per annum down from a peak of 4.27% in 2005 according to moneysherpa analysis of BPFI drawdown data.

Key Housing Statistics Ireland 2023

1. What percent of people are homeowners in Ireland 2023?

67% of all Irish households own their own home based on CSO census data.

| Housing [1] | Volume | Percentage % |

|---|---|---|

| Home Owners | 1,147,552 | 67% |

| Households Renting | 545,006 | 32% |

| All Households | 1,697,665 | – |

2. What percent of people rent in Ireland 2023?

32% of households rent based on the latest CSO data.

| Housing [1] | Volume | Percentage % |

|---|---|---|

| Home Owners | 1,147,552 | 67% |

| Households Renting | 545,006 | 32% |

| All Households | 1,697,665 | – |

3. What is the average monthly rent in Ireland 2023?

The average monthly rent is €1,464 compared to the average monthly mortgage repayment with a 50% deposit of €976.

| Housing | Monthly |

|---|---|

| Household Rent [1] | €1,464 |

| Mortgage repayment[2] | €1,757 |

| Mortgage repayment (inc HTB)[3] | €1,562 |

| Mortgage repayment (inc HTB & FHS)[4] | €976 |

[2] Scenario: 10% Deposit, Best rate,€370,000, 22 year term including Help to Buy (HTB) scheme.

[3] Scenario: 20% Deposit, Best rate,€370,000, 22 year term including Help to Buy (HTB) scheme.

[4] Scenario: 50% Deposit, Best rate,€370,000, 22 year term including HTB and First Home Scheme(FHS).

4. What is the average house price in Ireland 2023?

The median house price is €370,000 for a new house and €275,000 for an existing property.

| Housing | Median Price [1] |

|---|---|

| New House Price | €405,082 |

| Existing House Price | €322,602 |

Sources: Central Bank Mortgage Arrears, Central Bank Retail Interest Rates, Central Bank Private Household Credit and Deposits, CSO 2016 Census Data, BPFI Quarterly Drawdowns Data, Property Price Register, Residential Tenancies Board, Daft.ie Property Price Index