I offer investment advice to Irish financial advisors, and my role is to help my clients make the right choices, at the right time, when looking to invest in Ireland. This article cuts through all the noise to give you the information you need to make better investment choices. If you’re Investing in Ireland here’s what you need to know in 2021.

Share valuations are at record highs versus company earnings and markets are jumpy with COVID-19 still at large. Yet given the potential risks, equity stocks must still be viewed as a sound investment in the current climate, as we look forward to multiple vaccine roll-outs, upgraded growth forecasts and continued central bank and government support.

A recent investor survey highlights a shift in investor sentiment, as investors look to move away from over owned US markets, driving an increased capital flow to value opportunities across Europe and other regional markets

In particular, UK stocks may offer the best value opportunity of all, as the market with a notable lack of technology stocks starts to play out a post-Brexit catch-up. Although the Brexit drama has resulted in a notable “skinny trade deal”, UK equities have a lot of ground to make up on Global markets performance since the referendum in mid-2016.

After a bit of a battering in recent months, gold has bounced back and is a good way to balance out your investment in shares. The need for diversification will drive continued demand for gold, amongst the unprecedented money printing by central banks at present.

Read on to get more Investing in Ireland insights including

Party like it’s 1921 – vaccine a shot in the arm for shares in 2021

Don’t fight the fed – why government policy will continue to prop up long term share valuations

Sanity Clause – Brexit done, British shares to bounce back in 2021?

In a nutshell – the vaccine, stimulus & brexit triple booster

What next? – Further investing in Ireland insights

Party like it’s 1921 – vaccine a shot in the arm for shares in 2021

The western world faces into the new year armed with 3 effective vaccines to control the COVID-19 pandemic.

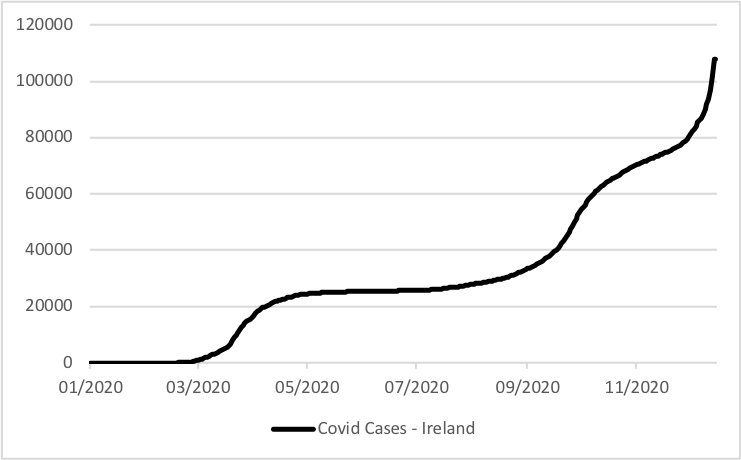

Inoculation programmes cannot come at a moment too soon. COVID-19 is currently surfing its third major wave since the pandemic erupted. In Ireland, caseloads have exploded, with the fastest-growing infection rate across the EU. Straining the capacity of the healthcare system and prompting severe lockdown restrictions.

Ireland’s pattern of renewed societal restrictions is a broadening theme across the global economy. Lending even sharper focus to rapid vaccine deployment.

So far, 13m doses have been administered in 33 countries worldwide, of which 4.7m have occurred in the United States, 1.4% of the population. Remarkably, the Israeli government has already managed to administer double-doses to 14% of its people. China is also broadening distribution of it’s vaccine, with 4.5m doses already administered, 3m of which in the past 3 weeks alone.

Elsewhere, vaccine programmes will ramp-up over the next few months. All of the major economic blocs have pre-ordered sufficient doses to put herd immunity within reach by late-Summer, if not sooner, with all things going to plan.

This represents a massive shot in the arm for the global economy, whose historic 4.4% contraction in 2020 may now see a 6%+ springback. Demand for economic goods and services did not die last year, rather it was suspended. It is pent-up demand that informs more bullish outlook for the global economy in 2021/22.

Some more excitable commentary heralds the dawning of this century’s Roaring Twenties which followed WW1 and the Spanish Flu. Whilst this is simplistic, Irish investors could see roaring returns from the right investment selections.

Don’t fight the fed – why central bank policy will continue to prop up long term share valuations

Traditionally, working out whether a company’s shares were a good investment focussed heavily on dividing a company’s share price by the associated earnings of the firm. The higher this ratio, the less of a bargain you are getting, all else being equal. This guideline ratio is at a documented all-time high in the S&P500 (a composite index of the top 500 companies in the US), and this has been a source of caution for investors right now, and understandably so.

Yet, the current central bank policies that are stimulating the economy have altered this equation. The size of the stimulus is difficult to grasp, COVID-19 and its associated lockdowns triggered a vast $13trn fiscal stabilisation effort last year. Roughly 15% of global GDP.

The lack of other viable investment options will continue to drive more investors into buying shares, driving up values above ratios that would have been considered as historically high. The reduction to US yields has however rendered any historical comparison to the time proven P/E ratio as obsolete. More specifically, the standard equity risk premium against current US Treasury yields allows for a higher P/E ratio.

Significantly, US Federal bank chair Jerome Powell saw fit to comment on this last month. “if you look at P/Es (price to earning ratio’s), they’re historically high, but in a world where the risk-free rate is going to be low for a sustained period, the equity premium, which is really the reward for taking equity risk, is what you’d look at”.

These conditions and the resulting premium is set to continue with Powell pledging that “we’re going to keep policy highly accommodative until the expansion is well down the tracks”.

Market commentators now appear to be singing off the same hymn sheet. Expecting stronger equity and commodity markets, flatlining bond yields and a weaker US dollar. This all points to share valuations holding up well compared to the assets that are traditionally perceived as lower risk such as bonds.

Sanity Clause – Brexit done, British shares to bounce back?

The sealing of a 1246-page free trade agreement (FTA) between UK and EU negotiators at 14.44 CET on Christmas Eve, brought to an end 9 months of fractious and repetitive talks.

For all the obvious shortcomings of the deal, improvements across UK financial assets brought a difficult 2020 to a more optimistic close.

Sterling ended the year at its highest level versus the weakening USD since April, 2018. The FTSE100 outperformed its major stock market peers for the second consecutive month.

Brexit uncertainties have weighed heavily on the UK economy since mid-2016. Investors, both domestic and overseas, have abandoned UK stocks in the pursuit of richer pickings elsewhere. This condemned the UK market to wallow at record low valuations relative to US and global peers.

The FTSE100 has barely risen in the post Brexit referendum period. For those investing in Ireland and trading in Euro’s it has actually returned a cumulative 5.5% loss. This compares to a 67.5% gains for the US market S&P 500 and 51.2% for World market MSCI World.

Now, with the weight of Brexit uncertainty lifted, investors are likely to seek value in the UK stock market driving gains. Respondents to December’s BAML Global Fund Manager Survey were already turning less bearish (less downbeat) towards UK equities.

In a world where shares are still the value play, UK shares look like the best value of all.

In a nutshell – the vaccine, stimulus & Brexit triple booster

The year ended in festive financial mood.

Thanks to the initial vaccination roll-out for COVID-19 and a further $900bn stimulus deal on Capitol Hill. The MSCI World led a host of major equity indices to fresh record peaks by year-end. Up 14.3% across the full-year, with a 68.3% rebound from late-March lows. The S&P500 saw a 16.3% rise compared with average 11.8% gains over the previous ten years.

Other assets performed poorly. Bond markets remained close to historic lows. The Dollar remained weak closing at the lowest levels since April 2018. As a result, Gold rebounded to complete its biggest annual advance since 2010.

This points to shares in general still being a sound investment in 2021, whilst gold continues to provide a source of diversification amidst the unprecedented money printing by central banks at present. The commodity is a good way to provide balance to an increased equity exposure across a portfolio, particularly at time in which bonds yields are returning next to nothing.

UK stocks may indeed represent the best equity value opportunity at the moment, as they are playing catch-up with the other markets post-Brexit.

What next? – Further investing in Ireland insights

You can read our more investing in Ireland analysis here.

You can check out our other guides on Investing in Ireland here.

You can find out where to get individual investing in Ireland and financial advice in your area here.